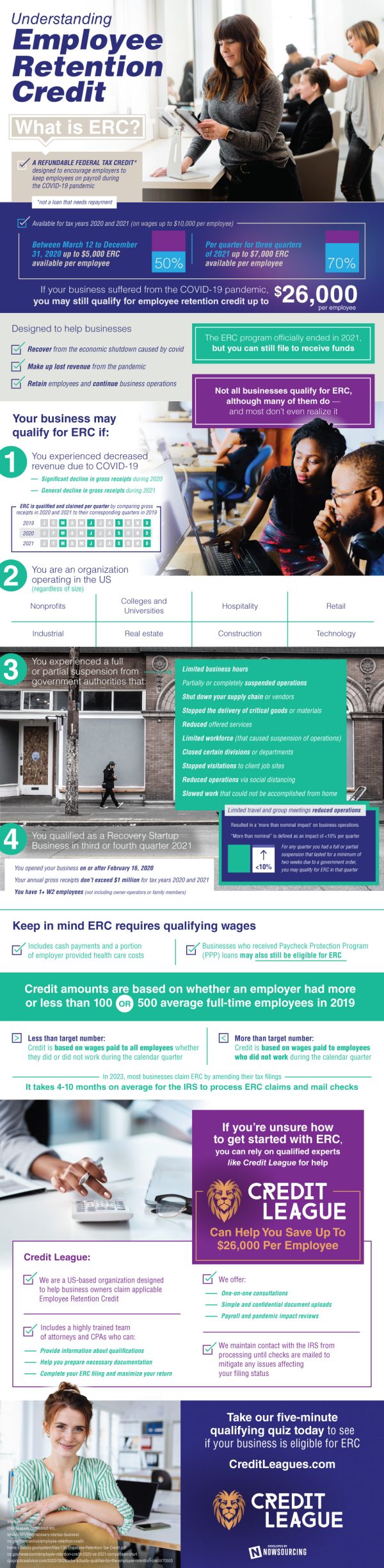

During the upheaval caused by the COVID-19 pandemic, the U.S. federal government introduced the Employee Retention Credit (ERC). This initiative was not a loan requiring repayment, but a refundable federal tax credit. The goal? Encourage businesses to keep their employees on the payroll amidst challenging times.

Available for tax years 2020 and 2021, the ERC differed in the amount credited per annum. In 2020, it provided a 50% credit of up to $10,000 in wages paid per employee, capped at $5,000 per employee. In 2021, it was more generous. The ERC amounted to a 70% credit of up to $10,000 in wages per employee per quarter for three quarters, totaling between $21,000 and $28,000 per employee.

For newer companies, the Employee Retention Credit offered an added benefit. Businesses opened after February 16, 2020, with less than $1,000,000 in revenue, had an additional opportunity. These Recovery Startup Businesses could file for the fourth quarter of 2021, yielding a total of $26,000 to $33,000 in tax credits per employee.

Your business might qualify for ERC if it experienced a significant decline in gross receipts in 2020 or decreased revenue due to COVID-19. The eligibility extended to various sectors, including nonprofits, retail, industrial, real estate, and more. The ERC evaluation was based on gross receipts comparison per quarter in 2019, 2020, and 2021.

Employee Retention Credit also considered businesses impacted by government-imposed restrictions. If your operations were affected to a more than nominal extent, defined as an impact of less than 10% per quarter, your business might be eligible.

The ERC required the inclusion of qualifying wages, involving cash payments and part of employer-provided healthcare costs. Even businesses that received Paycheck Protection Program (PP) loans could still qualify. In 2023, most businesses claimed the ERC by amending their tax filings, a process taking 4-10 months on average for the IRS to process.

Despite the Employee Retention Credit program’s official conclusion in 2021, businesses can still file for funds. If you are uncertain about the process, professionals like Credit League can help. Their team of attorneys and CPAs is well-equipped to help businesses navigate the intricacies of ERC claims and maximize their return.