The holidays are right around the corner, and consumers are beginning to think about gift-giving. Paying attention to spending patterns is an important step for retailers and lenders as they prepare for a successful holiday season.

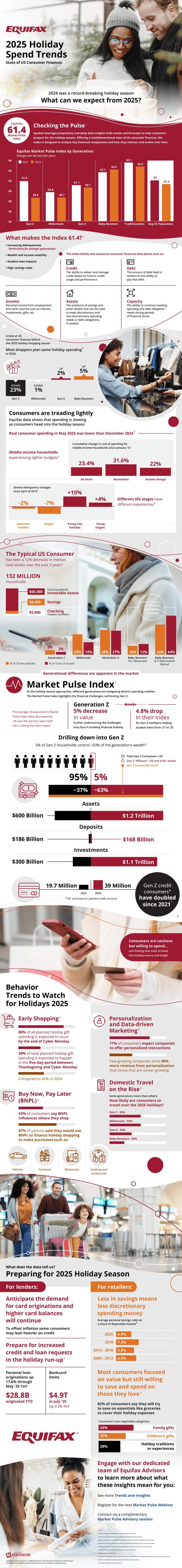

Overall, consumers are approaching holiday spending with increased caution. Over the past three years, the typical US buyer has experienced a 12% decrease in their median total assets. Only Baby Boomers escaped unscathed, enjoying an increase in median total assets over the same time period.

Gen Z, on the other hand, has been hit hard by financial struggles and inequality. In fact, 5% of Gen Z households control roughly 63% of the generation’s wealth, leading to significant disparity. Gen Z has also seen a greater decrease in its Market Pulse Index value than any other generation.

Increased financial pressure has led consumers to make careful spending choices. However, this does not mean that people are cutting out spending altogether; rather, consumers are moving slower and prioritizing value and personalized interactions. In fact, 71% of modern consumers expect retailers to offer personalized marketing and interactions.

Consumers are also prioritizing retailers that allow Buy Now, Pay Later (BNPL) plans. 43% of consumers say that BNPL impacts where they choose to shop, and 67% of parents report that they would use BNPL for holiday shopping, especially for items such as vehicles, furniture and electronics.

Tapping into personalization and high value products is key for retailers. For lenders, it is important to prepare for increased credit and loan requests as the holidays near, and to anticipate the demand for card originations and higher card balances.

Financial pressure is creating new consumer spending trends in 2025, resulting in intentional spending and a focus on value. Understanding this will go a long way for retailers and lenders hoping to find success this holiday season.