Credit scores are a vital sign of someone’s financial wellbeing in the United States. Numerous aspects of a person’s life, including housing opportunities, lower interest rates, and loan approvals can be impacted by their score. Anyone wishing to accomplish significant financial objectives, such as becoming a homeowner, must have a high credit score. Having a long history of reliably making on-time loan repayments will help achieve a high score.

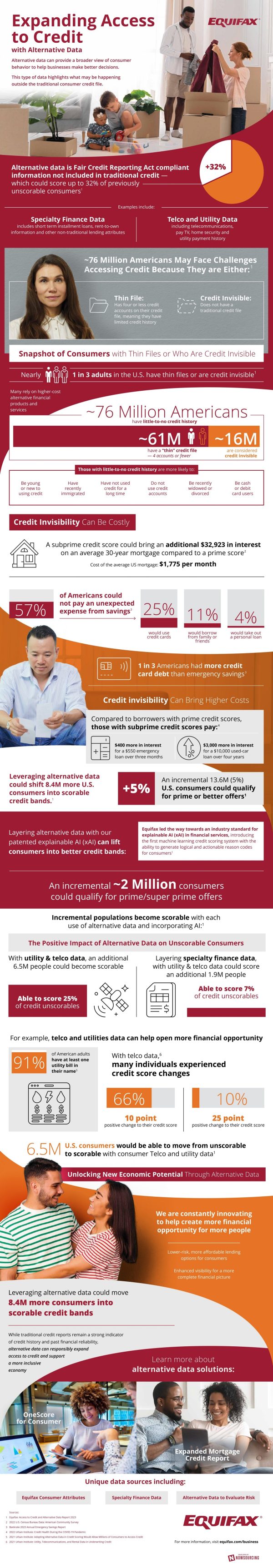

However, over 76 million Americans suffer from having limited credit history. This category can be further subdivided into two groups: 61 million individuals with thin credit files and 16 million individuals with no credit history. Individuals who primarily utilize cash, young adults, immigrants, and widows are disproportionately impacted, making them more financially vulnerable.

These high interest rates on loans can be detrimental to someone’s financial wellbeing. Over the duration of the loan term, it may result in exorbitant levels of interest that cost borrowers tens of thousands of dollars more. For example, over the course of a 30 year mortgage, a homeowner with a low credit score can accrue an extra $30k in interest payments. Access to emergency loans is also dependent on having a high credit score, which is dangerous because many Americans lack the funds for unforeseen expenses.

One growing trend to address these issues is the use of alternative data in the credit rating process. This FCRA-compliant data illustrates a borrower’s reliability by accessing non-traditional payment histories, like utility and phone bills. A significant section of the previously unscorable population may now prove their creditworthiness and obtain credit thanks to this inclusive approach.

Alternative data can eliminate the challenges that millions of individuals encounter when attempting to obtain credit since it provides a more comprehensive and inclusive assessment of financial activities. This advancement in credit scoring also enables lenders to make more thorough decisions, which leads to the development of a more equitable financial system.