Our Latest Articles

Learn about Purium

Purium Code And Coupons

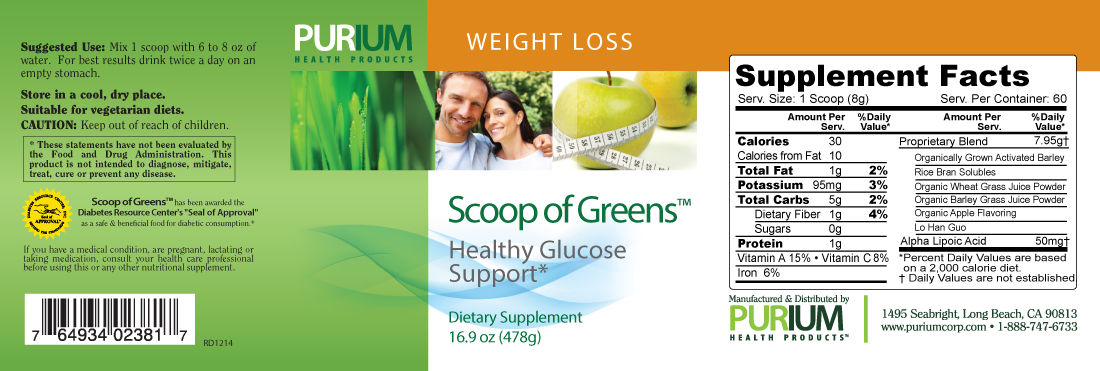

BIGGEST Discount Purium Code: ** Verified to Work** Where to Get Purium Discount Codes? Want to know how to get a referral code for Purium? Well, you’ve come to

Purium Health Products

Purium Health Products: Your Path to a Healthier Lifestyle! Pure & Premium Nutrition Formulated with Your Health in Mind, that is what Purium is all about. Reboot your health and

Where To Buy Purium Products?

One of the best ways to buy our awesome products for a great deal is through buying direct from Purium. Buying Purium products online is fast and easy. But beware

Get Paid to Exercise

Use the App on Your Phone to track your workout and get real $$ - U.S. Residents only.

Purium Products

-

Pineal Clear

Exploring Pineal Clear: A Comprehensive Approach to Enhanced Brain and Sleep Health In the pursuit of mental clarity and quality sleep, holistic health practitioners often turn to the wisdom of nature. Purium’s Pineal Clear emerges as a product of such wisdom, crafted with a blend

-

Essential Mushroom

For generations beyond count, mushrooms have been held in high regard, cherished by numerous cultures for their remarkable health benefits. Today, Purium honors this age-old wisdom with their Essential Mushroom Blend, a certified organic concoction that draws upon the revered legacy of five organic functional

-

Essential Mocha Mushroom

Have you ever wondered about the secrets of mushrooms that people have been talking about for thousands of years? Well, Purium’s Essential Mocha Mushroom mix is like finding a treasure chest in the world of health. This special mix includes five amazing mushrooms that have

-

Essential Golden Mushroom

In the realm of health and wellness, few natural elements carry as much mystique and historical reverence as mushrooms. For thousands of years, spanning numerous civilizations, these fascinating fungi have been celebrated for their health-enhancing properties. Purium‘s Essential Mushroom Blend is a testament to this

-

Collagen Support Pack

What is the Collagen Support Pack? The Collagen Support Pack from Purium is designed to provide your body with the essential building blocks it needs to produce and maintain collagen. Collagen is a vital protein found in the body that plays a crucial role in

-

Matcha Protein

Matcha Protein Imagine waking up each morning with a burst of energy without having to step out for your daily café run. Now, it’s not just a dream! Purium’s Matcha Protein offers a delicious and nutritious alternative that’s perfect for anyone looking to fuel their

-

Coffee Protein

Coffee Protein Skip the trip to the café and enjoy a nutritious morning boost right at home with our Coffee Protein. Made from the same premium protein source as MVP Sport, this coffee-flavored powder is a delicious way to fuel your body throughout the day.

-

Chai Protein

Chai Protein Introducing our Chai Protein, a delicious and healthier alternative to your morning café pick-me-up. Made from the same premium protein source as our MVP Sport, this chai-flavored supplement is packed with pure and premium ingredients to give you sustained energy throughout the day.

-

Dark Berry Protein

Purium Dark Berry Protein Shake Purium’s Dark Berry protein shake makes a delicious and nutritious snack or meal. It provides 12 phytonutrient packed fruits and berries plus a full serving of organic vegan protein, and is complemented by medium chain triglycerides, ginkgo biloba, and lion’s

-

Healthy Immune Function Pack

Strong Immune System Support Are you looking for additional immune support considering the unprecedented health challenges over the last few years? Consider this pack of 3 Purium products that will support your immune system and provide an additional edge against those things trying to infect

-

Food Supply Packages

COVID-19 is really playing havoc with our lives, and now it is threatening to impact our food chain. If you haven’t already taken steps to make sure you have healthy food in your home that will sustain you and your family, you are behind. Here

-

Allergy Reduction Pack

Allergy and the Body’s Response Allergies are not rare, and chances are you and/or someone you know has at least one. Allergens are objects/substance that threaten your body’s immune system. You might have be wondering, is there an easier and more natural way to manage

-

Men’s Defense

Prevention is everything, Men’s Defense This natural formula includes saw palmetto berry, nettle, pygeum, red clover and pumpkin seed and comes from various cultures across the globe. Each of these special ingredients function synergistically to assist the male body’s defense against health concerns unique to

-

ZinC-ADE

Strong Immune System Support – ZinC-ADE Are you looking for additional immune support considering the unprecedented health challenges over the last few years? ZinC-ADE by Purium is our “first line of defense” product to support your immunity! ZinC-ADE delivers specific, targeted, plant-sourced nutrients (Zinc and